Rental Income On Tax Return . learn how to report rental income on your tax return, including the rental income tax rate, important forms, and special rules. this guide will help you determine your gross rental income, the expenses you can deduct and your net rental income or loss for the. learn how to report rental income and expenses on your tax return, whether you rent real estate or personal property. — you can deduct expenses from your rental income when you work out your taxable rental profit as long as they are. This is your ‘property allowance’. — learn how to use schedule e (form 1040) to report income or loss from rental real estate and other sources. — you must declare all the income you receive for your rental property (including from overseas properties) in. Find out how to deduct expenses,.

from www.bank2home.com

this guide will help you determine your gross rental income, the expenses you can deduct and your net rental income or loss for the. Find out how to deduct expenses,. This is your ‘property allowance’. learn how to report rental income and expenses on your tax return, whether you rent real estate or personal property. — you must declare all the income you receive for your rental property (including from overseas properties) in. learn how to report rental income on your tax return, including the rental income tax rate, important forms, and special rules. — you can deduct expenses from your rental income when you work out your taxable rental profit as long as they are. — learn how to use schedule e (form 1040) to report income or loss from rental real estate and other sources.

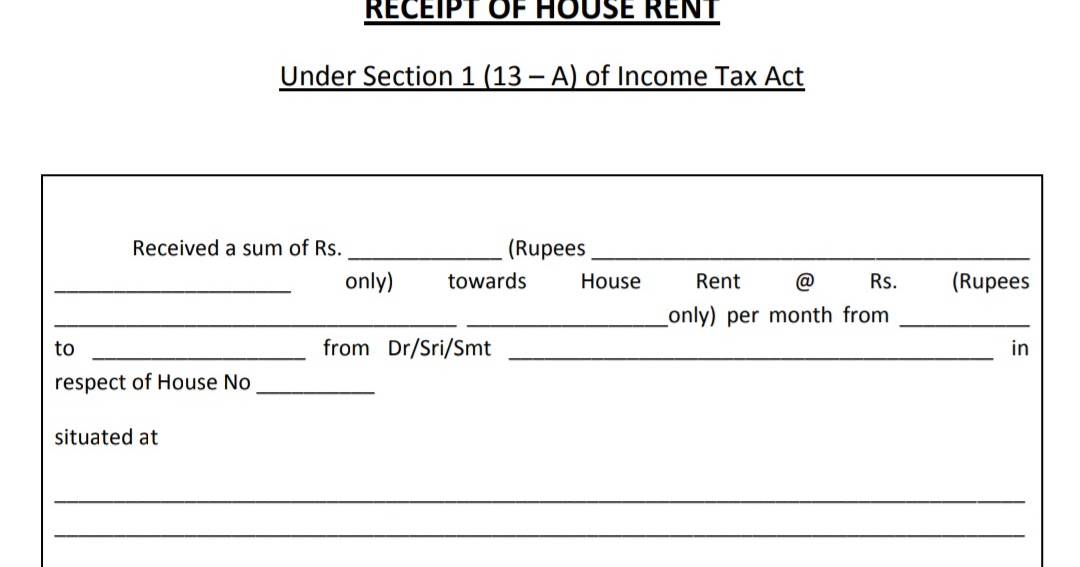

Rent Slip Format For Tax Sample Templates

Rental Income On Tax Return learn how to report rental income and expenses on your tax return, whether you rent real estate or personal property. this guide will help you determine your gross rental income, the expenses you can deduct and your net rental income or loss for the. — learn how to use schedule e (form 1040) to report income or loss from rental real estate and other sources. — you can deduct expenses from your rental income when you work out your taxable rental profit as long as they are. Find out how to deduct expenses,. — you must declare all the income you receive for your rental property (including from overseas properties) in. learn how to report rental income on your tax return, including the rental income tax rate, important forms, and special rules. This is your ‘property allowance’. learn how to report rental income and expenses on your tax return, whether you rent real estate or personal property.

From www.vrogue.co

Printable Rental And Expense Worksheet Printab vrogue.co Rental Income On Tax Return learn how to report rental income and expenses on your tax return, whether you rent real estate or personal property. — you must declare all the income you receive for your rental property (including from overseas properties) in. this guide will help you determine your gross rental income, the expenses you can deduct and your net rental. Rental Income On Tax Return.

From fincalc-blog.in

Tax Calculation for FY 202324 [Examples] FinCalC Blog Rental Income On Tax Return learn how to report rental income on your tax return, including the rental income tax rate, important forms, and special rules. — you must declare all the income you receive for your rental property (including from overseas properties) in. — learn how to use schedule e (form 1040) to report income or loss from rental real estate. Rental Income On Tax Return.

From fabalabse.com

How much foreign is tax free in USA? Leia aqui How much Rental Income On Tax Return — you can deduct expenses from your rental income when you work out your taxable rental profit as long as they are. — you must declare all the income you receive for your rental property (including from overseas properties) in. learn how to report rental income on your tax return, including the rental income tax rate, important. Rental Income On Tax Return.

From landlordgurus.com

Rental Property Taxes 8 Tax Tips for Landlords Landlord Gurus Rental Income On Tax Return this guide will help you determine your gross rental income, the expenses you can deduct and your net rental income or loss for the. learn how to report rental income and expenses on your tax return, whether you rent real estate or personal property. Find out how to deduct expenses,. This is your ‘property allowance’. — learn. Rental Income On Tax Return.

From www.which.co.uk

How rental is taxed Which? Rental Income On Tax Return — learn how to use schedule e (form 1040) to report income or loss from rental real estate and other sources. — you must declare all the income you receive for your rental property (including from overseas properties) in. — you can deduct expenses from your rental income when you work out your taxable rental profit as. Rental Income On Tax Return.

From ck5354.blogspot.com

Tax on Rental oh Tax on Rental KLSE malaysia Rental Income On Tax Return — you can deduct expenses from your rental income when you work out your taxable rental profit as long as they are. This is your ‘property allowance’. — you must declare all the income you receive for your rental property (including from overseas properties) in. — learn how to use schedule e (form 1040) to report income. Rental Income On Tax Return.

From www.taxscan.in

Rental received from letting out property is taxable under head Rental Income On Tax Return this guide will help you determine your gross rental income, the expenses you can deduct and your net rental income or loss for the. — learn how to use schedule e (form 1040) to report income or loss from rental real estate and other sources. — you must declare all the income you receive for your rental. Rental Income On Tax Return.

From www.financialexpress.com

How tax on rental is calculated Stepbystep guide Tax Rental Income On Tax Return learn how to report rental income and expenses on your tax return, whether you rent real estate or personal property. — learn how to use schedule e (form 1040) to report income or loss from rental real estate and other sources. learn how to report rental income on your tax return, including the rental income tax rate,. Rental Income On Tax Return.

From taxwalls.blogspot.com

How To Calculate Rental For Tax Return Tax Walls Rental Income On Tax Return learn how to report rental income and expenses on your tax return, whether you rent real estate or personal property. this guide will help you determine your gross rental income, the expenses you can deduct and your net rental income or loss for the. — learn how to use schedule e (form 1040) to report income or. Rental Income On Tax Return.

From www.etsy.com

Rent Excel Template Online Tax File Rent Expense Etsy Ireland Rental Income On Tax Return Find out how to deduct expenses,. This is your ‘property allowance’. — you can deduct expenses from your rental income when you work out your taxable rental profit as long as they are. — learn how to use schedule e (form 1040) to report income or loss from rental real estate and other sources. learn how to. Rental Income On Tax Return.

From www.signnow.com

Cr a Commercial Rent Tax Form Fill Out and Sign Printable PDF Rental Income On Tax Return Find out how to deduct expenses,. this guide will help you determine your gross rental income, the expenses you can deduct and your net rental income or loss for the. — learn how to use schedule e (form 1040) to report income or loss from rental real estate and other sources. learn how to report rental income. Rental Income On Tax Return.

From 1044form.com

What Is Schedule E Here S An Overview For Your Rental 1040 Form Printable Rental Income On Tax Return This is your ‘property allowance’. — you can deduct expenses from your rental income when you work out your taxable rental profit as long as they are. learn how to report rental income and expenses on your tax return, whether you rent real estate or personal property. — learn how to use schedule e (form 1040) to. Rental Income On Tax Return.

From loquad.weebly.com

tax return acknowledgement receipt download loquad Rental Income On Tax Return learn how to report rental income on your tax return, including the rental income tax rate, important forms, and special rules. This is your ‘property allowance’. Find out how to deduct expenses,. — learn how to use schedule e (form 1040) to report income or loss from rental real estate and other sources. learn how to report. Rental Income On Tax Return.

From www.facebook.com

Business & Rental Tax Return How to save Tax Rental Income On Tax Return — learn how to use schedule e (form 1040) to report income or loss from rental real estate and other sources. Find out how to deduct expenses,. learn how to report rental income on your tax return, including the rental income tax rate, important forms, and special rules. this guide will help you determine your gross rental. Rental Income On Tax Return.

From www.wiseup.nz

Tax On Rental Tax Advice Property Investors Rental Income On Tax Return learn how to report rental income and expenses on your tax return, whether you rent real estate or personal property. Find out how to deduct expenses,. — learn how to use schedule e (form 1040) to report income or loss from rental real estate and other sources. This is your ‘property allowance’. — you must declare all. Rental Income On Tax Return.

From www.formsbirds.com

Tax Statement Form 2 Free Templates in PDF, Word, Excel Download Rental Income On Tax Return — you must declare all the income you receive for your rental property (including from overseas properties) in. This is your ‘property allowance’. — you can deduct expenses from your rental income when you work out your taxable rental profit as long as they are. learn how to report rental income and expenses on your tax return,. Rental Income On Tax Return.

From www.bank2home.com

Rent Slip Format For Tax Sample Templates Rental Income On Tax Return — learn how to use schedule e (form 1040) to report income or loss from rental real estate and other sources. This is your ‘property allowance’. Find out how to deduct expenses,. this guide will help you determine your gross rental income, the expenses you can deduct and your net rental income or loss for the. learn. Rental Income On Tax Return.

From incometaxformsgorokura.blogspot.com

Tax Forms Rental Tax Forms Rental Income On Tax Return this guide will help you determine your gross rental income, the expenses you can deduct and your net rental income or loss for the. Find out how to deduct expenses,. — you can deduct expenses from your rental income when you work out your taxable rental profit as long as they are. This is your ‘property allowance’. . Rental Income On Tax Return.